SMU Student Medical Insurance

Insurance Provider: Income Insurance Limited

Insurance Broker: Mercer Marsh Benefits

Policyholder: Singapore Management University

Policy Period: 1 July 2025 to 30 June 2026

Policy Number: 2100653158 (Local students) / 2100653765 (International students)

ELIGIBILITY

Registered active students of Singapore Management University (SMU):

- Full-time local and international Undergraduate students

- Full-time and part-time local and international Postgraduate students

- Full-time Non-graduating students (e.g. International exchange and global summer programme students)

- Local NSMen who have matriculated as SMU students

- Other student groups included or excluded as defined by SMU

IMPORTANT:

Cessation of the student insurance coverage is based on a student's graduation date*.

*The day the dean clears the graduation list is the official graduation date. Please note that the graduation date is NOT the same as commencement date.

NOTE:

- Students of the Singapore Universities Student Exchange Programme (SUSEP) will be covered under their home university.

- Students of the SMU-SUTD Dual Degree Programme will be covered under SUTD.

- Students of the Industry Graduate Diploma Programmes (IGD) are not covered under the SMU Student Insurance Plans.

- Local refers to Singaporeans or Singapore Permanent Residents.

- All full time SMU matriculated undergraduates, postgraduates and non-graduating students will need to subscribe to the university medical and travel insurance schemes. These are compulsory schemes with no opt-out option. Paid premiums are non-refundable.

INSURANCE COVERAGE

All eligible students are covered under the medical and personal accident insurance plans listed below.

For more information, please refer to the respective Product Summary & Schedule of Benefits and FAQs.

> Student Medical Insurance FAQs

| Insurance Plan | Coverage Details |

|---|---|

| Group Outpatient Clinical Care (GP) | Covers treatment by a General Practitioner (GP) in Singapore for illness or injury, including consultation, prescribed standard medicine and telemedicine*. > Panel GP Clinic Listing |

| Group Outpatient Specialist Care (SP) | Covers outpatient specialist treatments including mental health treatment, at Panel Specialist Outpatient Clinics (SOCs) in Singapore Government Restructured Hospitals: Note: |

| Group Hospital & Surgical Insurance (GHS) | Covers eligible medical expenses incurred for hospitalisation and/or surgery for treatment of illness or injury, in a Singapore Government Restructured Hospital: Note: |

| Group Personal Accident Insurance (GPA) | Reimbursement of eligible sum upon death and/or permanent disablement as a direct result of accident or injury. |

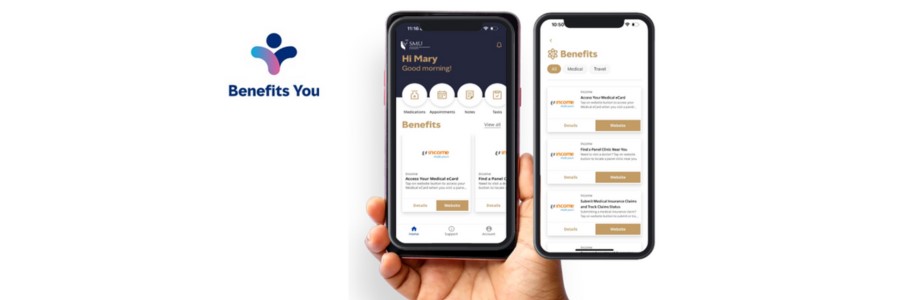

Benefits You App (BYA)

The Benefits You App (BYA) is a collaboration with Mercer Marsh Benefits (MMB), SMU's insurance broker, for an easier and more convenient way for students to manage their insurance claims, health and wellbeing - anytime, anywhere.

Students are highly encouraged to download and enrol onto BYA for access to the student medical insurance benefits or to submit medical insurance claims, if any.

Features of the Benefits You App (BYA) to meet your medical insurance needs:

- Access your medical insurance benefits

- Use your medical e-card for cashless visists at panel GP clinics

- View the full list of panel GP clinics

- Submit and track your medical insurance claims

- Apply for a Letter of Guarantee (for hospitalisation at government restructured hospitals)

- Get the latest news and tips on health, mindfulness and wellbeing

- Use built-in tools to track appointments, manage medications and more

Follow the steps below to download and enrol onto BYA:

- Download the Benefits You App (BYA) from the App Store or Google Play.

- Register as a user using your full name, SMU email address and company code: SMUSG2539.

For more information and assistance on the set-up of BYA, refer to the BYA Guide.

For app issues or technical support, contact the MMB Team at benefitsyouasia@mercermarshbenefits.com

NOTE:

Access to the Benefits You App (BYA) will be withdrawn once you cease to be a student of SMU, to safeguard and protect the privacy of your personal information.

If you have any pending insurance claims, please contact Mercer Marsh Benefits Customer Service Consultant via:

Telephone: +65 6797 9613 (Enter Client ID: 2539)

Monday to Friday (excluding public holidays)

8:30am to 5:30pm

Email: eh&b@mercermarshbenefits.com

GroupCare@Income app (for telemedicine)

Consultations with panel GP clinics via telemedicine are only applicable through the GroupCare@Income app. Follow the steps below to download and enrol onto the GroupCare@Income app.

- Download the app from the Apple App Store or Google Play Store

- Register as a user using your full name and SMU email address

- Log-in to access the app

- On the home screen, select the 'Telemedicine' function

- Complete the required details before proceeding to use the telemedicine service

For more information and assistance on the set-up of GroupCare@Income, refer to the GroupCare@Income Guide.

SUBMISSION OF CLAIMS

All claims must be submitted together with the relevant supporting documents via the Income Claims e-portal in the Benefits You App (BYA). All claims will be reviewed by the insurer and subjected to the policy limits, terms and conditions.

Follow the steps below to submit your claims via BYA:

- Access BYA > Benefits > Medical

- Under Income - Submit Medical Insurance Claims, select the 'Website' button

- Select 'Create New Claim' to file your claim

Complete the information / details of your claim and submit together with the relevant supporting documents

IMPORTANT:

- Claims must be submitted within 30 days of treatment date. Late claims may not be processed.

- Claimant must use their full name as per NRIC/FIN/Passport No. and SMU email in their claims submission and correspondence.

- The original invoices and receipts should be kept for one (1) year and provided upon request by the insurer.

- The student’s Singapore bank account details must be entered in the app/portal when submitting a claim. The details required include account number, bank code and branch code. Please do not provide bank details belonging to another party (who is not the claimant).

International Students without a Singapore Bank Account: Exception is made only for certain groups of international students who do not have a bank account in Singapore (e.g. Exchange / Summer programme students). Any approved claims for such groups of students will be paid via Telegraphic Transfer (TT) to their designated bank account of their home country. Kindly follow the steps below to submit the insurance claim.

- Download and complete the benefit claim form. Kindly leave the last section blank (Page 3 titled 'To be completed by employer/union').

- Email the form together with the relevant supporting documents as well as TT bank details listed below, to groupcare.mhc@hmimanagedhealthcare.com.i. Name of bank account holder:

ii. BIC/SWIFT address:

iii. IBAN (International bank account number):

iv. Bank code:

v. Branch code:

vi. Bank name:

vii. Bank address:

viii. Bank account number:Note:

Any administrative charges arising from the telegraphic transfer will be borne by the claimant. These charges will be offset from the amount of the approved claims, before reimbursement back to the claimant.

Documents / information required for claims submission:

- Claimant's personal and contact information

Scanned / softcopies of supporting documents (where applicable) including, but not limited to:

- Hospital bill / invoice

- Medical receipt

- Medical report

- Medical certificate

- In-patient discharge summary

- Incident report

- Police report

- Referral letter- Claimant's bank account information (for reimbursement of approved claims via GIRO)

POLICY & CLAIM ENQUIRIES

Mercer Marsh Benefits Customer Service Consultant (Primary Contact)

Monday to Friday (excluding public holidays)

8:30am to 5:30pm

Telephone: +65 6797 9613 (Enter Client ID: 2539)

Email: eh&b@mercermarshbenefits.com

On-site Consultation at Student Services Hub (SSH)

Term 1 & Term 2 only

Every Tuesday (excluding public holidays)

10:00am to 12:00noon

Income (Secondary Contact)

Telephone: +65 6305 4573

Email: groupcare@mhcasiagroup.com